Co-Operative Loan Report

Table of contents

- Project brief

- Objective

- Key Questions to Answer

- Data source

- Tools

- Dashboard design charts

- Stages

- Data Cleaning Process

- Insights

- Recommendations

Project Brief:

Cooperative Loan Analysis

Objectives

The aim of this dataset is to provide detailed information on loan applications submitted to a co-operative financial institution. It includes applicant demographics, loan details, and approval status, allowing for a comprehensive analysis of trends, customer behavior, and business performance.

-

Analyze Loan Applications Across Demographics: Examine how age, marital status, education, and employment status influence loan application volume and approval rates.

-

Identify High-Value Customer Segments: Discover which groups (e.g. age, education level) are associated with higher loan amounts and better approval chances.

-

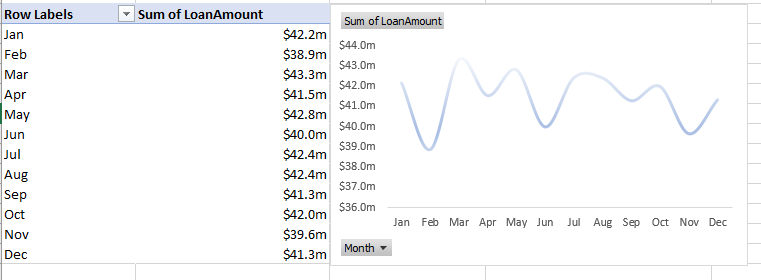

Understand Monthly Loan Trends: Track loan funding performance across different months to identify peak and low-performing periods.

-

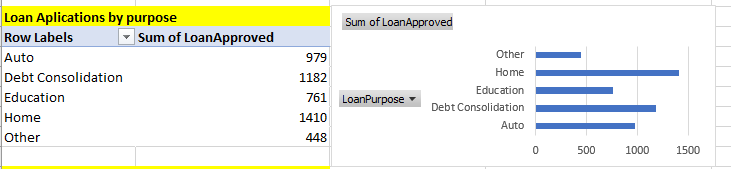

Explore Loan Purpose Distribution: Determine the most common reasons customers request loans and analyze the funding associated with each category.

-

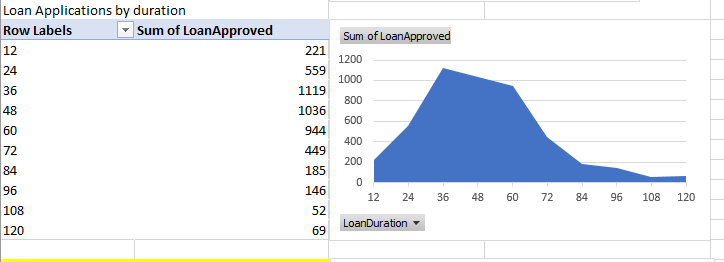

Assess Loan Term Preferences: Review preferred repayment terms among applicants to help design better loan products.

-

Support Data-Driven Decision Making: Provide actionable insights to help the organization optimize loan products, marketing efforts, and risk management.

Key Questions to Answer

-

In which months was loan funding highest and lowest?

-

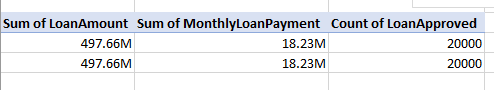

What is the total loan applications, funded amount and monthly payment.

-

Is there a consistent trend in loan funding across the year?

-

Are there any seasonal patterns in loan demand?

-

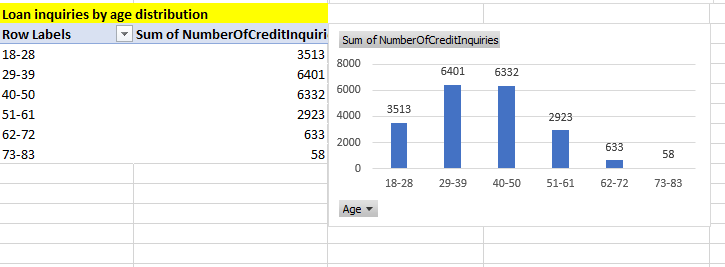

Which age group submits the most loan applications?

-

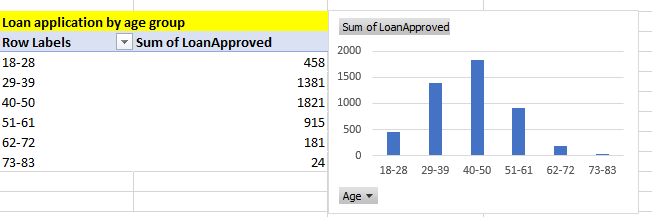

Which age group gets the most loan approvals?

-

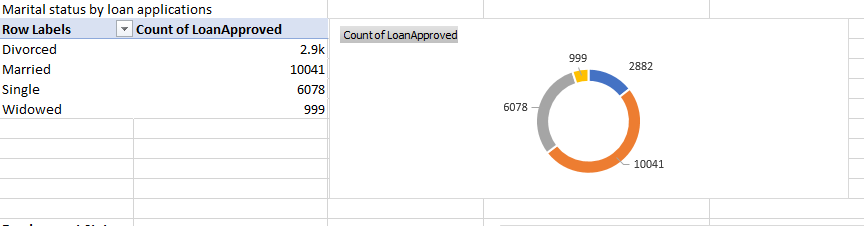

How does marital status affect the number of loan applications?

-

Do younger applicants (under 30) get loans approved as often as older ones?

-

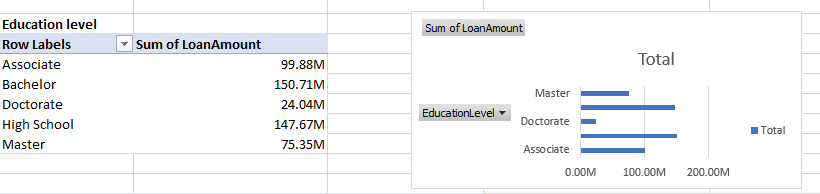

Which education level accounts for the highest loan amount?

-

Are loan applications correlated with the level of education?

-

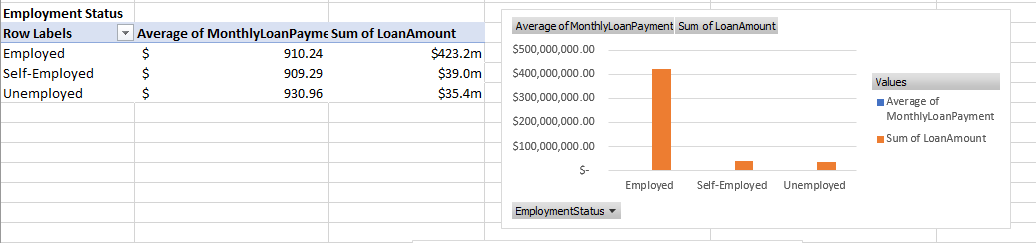

Which employment group (employed, self-employed, unemployed) requests the most loan funding?

-

Is there a risk in the high loan volume from unemployed applicants?

Data Source

Tools

| Excel | Cleaning, Processing, Pivot Tables |

Dashboard Mockup

Process of which the dashboard was designed

Stages

- Get data from source

- Load into Excel spreadsheet

- Clean and Process using functions, formulas and Pivot tables.

- Build Dynamic Dashboard using Charts

Processing

Insights

• Age Group: Applicants aged 30–50 dominate loan applications and approvals.

• Education Level: Individuals with Bachelor’s and Master’s degrees apply for the highest loan amounts.

• Loan Approvals: Most approvals go to applicants between 30–50 years old.

• Monthly Trend: Loan funding peaks around March, July, and September; dips in November.

• Marital Status: Married individuals account for 50% of all applications.

• Loan Purpose: Top purposes are auto, debt consolidation, and education.

• Employment: Employed applicants request the highest amount, but unemployed applicants also request large sums.

• Loan Term: Short- to mid-term loans (36–60 months) are most popular.

Recommendations

• Target Ages 30–50: Tailor marketing and loan products toward this active segment.

• Promote Education Loans: Customize student or continuing education loan packages.

• Review Unemployment Risk: High loan requests from unemployed applicants suggest a need for tighter screening.

• Enhance Offers for Married Applicants: Introduce bundled financial services or loyalty programs.

• Flexible Loan Terms: Focus offerings around the popular 36–60 month range.

• Boost Low-Season Activity: Use promotions during lower loan activity months like November.