Financial Loan Analysis

Table of Contents

- Project brief

- Objective

- Questions to Answer

- Data source

- Tools

- Dashboard design charts

- Development

- Data processing / Transformation

- Findings

- Recommendations

Project brief

Financial Loan Analysis

Objective

This report aims to provide insights into key loan-related metrics and their changes over time. The report will help us make data-driven decisions, track our loan portfolio’s health, and identify trends that can inform our lending strategies.

Questions to answer

-

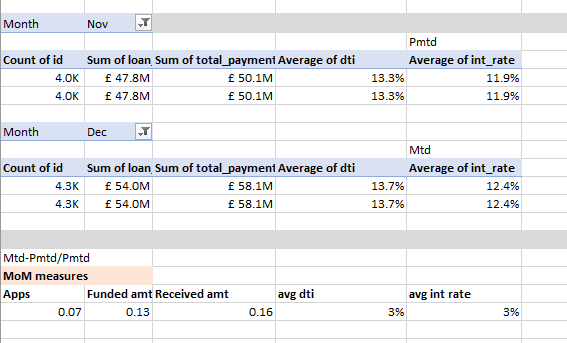

Total Loan Applications: We need to calculate the total number of loan applications received during a specified period. Additionally, it is essential to monitor the Month-to-Date (MTD) Loan Applications and track changes Month-over-Month (MoM).

-

Total Funded Amount: Understanding the total amount of funds disbursed as loans is crucial. We also want to keep an eye on the MTD Total Funded Amount and analyse the Month-over-Month (MoM) changes in this metric.

-

Total Amount Received: Tracking the total amount received from borrowers is essential for assessing the bank’s cash flow and loan repayment. We should analyse the Month-to-Date (MTD) Total Amount Received and observe the Month-over-Month (MoM) changes.

-

Average Interest Rate: Calculating the average interest rate across all loans, MTD, and monitoring the Month-over-Month (MoM) variations in interest rates will provide insights into our lending portfolio’s overall cost.

-

Average Debt-to-Income Ratio (DTI): Evaluating the average DTI for our borrowers helps us gauge their financial health. We need to compute the average DTI for all loans, MTD, and track Month-over-Month (MoM) fluctuations.

-

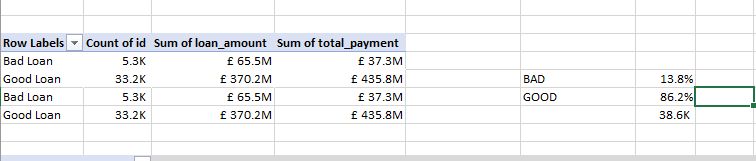

Good & Bad Loan Application Percentage: We need to calculate the percentage of loan applications classified as ‘Good Loans.’ This category includes loans with a loan status of ‘Fully Paid’ and ‘Current.’

-

Good & Bad Loan Applications: Identifying the total number of loan applications falling under the ‘Good Loan’ category, which consists of loans with a loan status of ‘Fully Paid’ and ‘Current.’

-

Good & Bad Loan Funded Amount: Determining the total amount of funds disbursed as ‘Good Loans.’ This includes the principal amounts of loans with a loan status of ‘Fully Paid’ and ‘Current.’

-

Good & Bad Loan Total Received Amount: Tracking the total amount received from borrowers for ‘Good Loans,’ which encompasses all payments made on loans with a loan status of ‘Fully Paid’ and ‘Current.’

Dataset

Data source

Here are the Data needed to achieve project goal

- Total loan applications (Month-to-date, Month-over-Month)

- Funded Amount (Month-to-date, Month-over-Month)

- Received amount (Month-to-date, Month-over-Month)

- Average Interest rate (Month-to-date, Month-over-Month)

- Average Debt to Income (Month-to-date, Month-over-Month)

- Home ownership

- Loan status

- Loan purpose

- Employment status

- Monthly trends

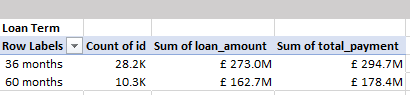

- Loan term

Tools

| Tools | Purpose |

|---|---|

| SQL | Cleaning, Standardization. |

| Excel | Processing, Visualizations. |

Dashboard design

Here is a list of appropriate chart visuals used answering key questions.

- Score cards

- Column chart

- Donut chart

- Line chart

- Scatter chart

- Tree map

- Bar chart

- Slicers

Development

Here’s a step by step guide on how the data was approached

- Getting the data

- Load and clean data with SQL queries

- Transfer data from SQL database into Excel

- Processing and Visualizations using Excel

- Generate Insights

- Give recommendations

Data Cleaning / Processing

The goal is to refine the dataset to ensure its clean and ready for analysis.

- Only relevant columns should be retained.

- All data types should be appropriate for the contents of each column.

- No column should contain null values, indicating complete data for all records

SQL Cleaning

Excel Processing

Findings

-

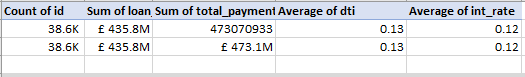

With 38.6K total applications but only £435.8M funded versus £473.1M received, indicating potential liquidity or risk management challenges.

-

DTI at 13% appears manageable, but the significant gap between funded and received amounts suggests funding capacity limitation.

-

Interest rate seems unusually low with 12%, which may be impacting profitability margins.

-

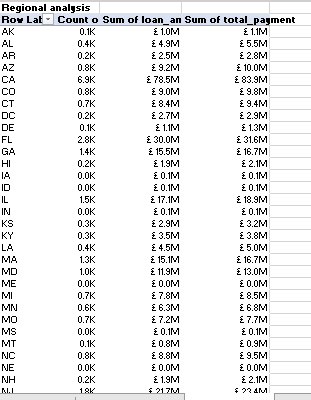

The loan distribution by region shows heavy concentration in specific areas, creating potential risk if those regions experience economic downturns.

-

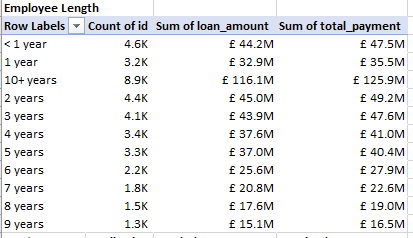

Varying loan performance across different employment tenure groups, with some segments showing higher risk profiles that need targeted strategies.

-

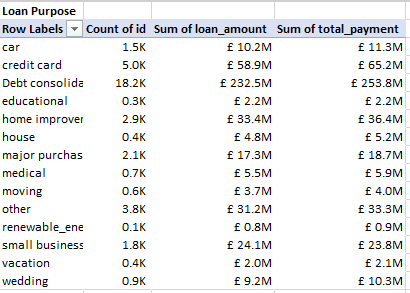

The breakdown reveals significant concentration in certain loan categories (debt consolidation, major purchases), suggesting need for product diversification.

Recommendations

-

Review funding capacity constraints that are limiting loan disbursements.

-

Analyze the pricing strategy given the low average interest rate.

-

Implement geographic diversification strategies to reduce concentration risk.

-

Develop targeted underwriting criteria for different employment length segments.

-

Create product offerings for underrepresented loan purposes.

-

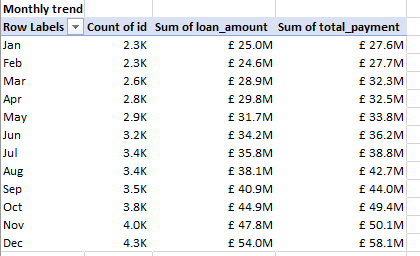

Establish monthly trending analysis to identify seasonal patterns and optimize timing.

Action plan

-

Target the mortgage and other loan categories that appear underrepresented.

-

Develop specialized products for different employment tenure groups.

-

Leverage the strong performance in certain regions for expansion.